|

|

|

|---|

|

|

|

|---|

|

|

|---|---|

|

|

|

|

|

|

|

|---|

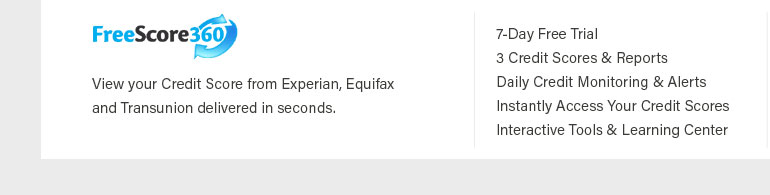

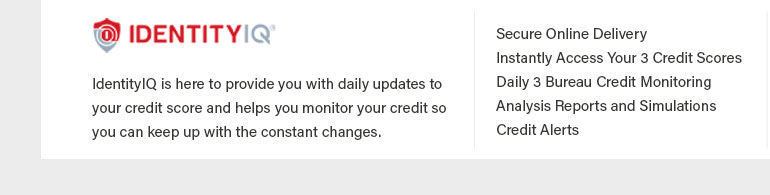

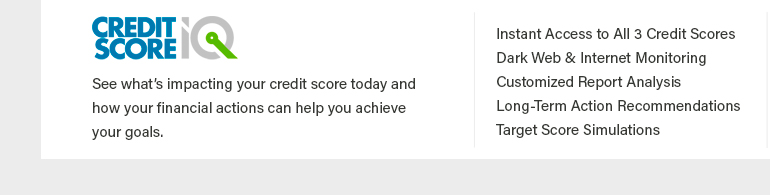

Three Credit Score Monitoring Options to Consider

Maintaining a healthy credit score is vital for financial well-being, and monitoring your credit score regularly is a proactive step towards this goal. In this article, we explore three popular credit score monitoring options, offering insights into their features and benefits.

Why Monitor Your Credit Score?

Credit score monitoring is essential for several reasons:

- Prevent identity theft: Quick detection of unauthorized activities.

- Improve credit health: Identify factors affecting your score.

- Financial planning: Better prepare for loans and credit applications.

Popular Credit Score Monitoring Options

Option 1: Credit Check Bureau

The credit check bureau offers comprehensive credit monitoring services with real-time alerts and monthly credit score updates. Users benefit from in-depth analysis of their credit reports and access to customer support for guidance.

Option 2: Credit Check Expedia

With a user-friendly interface, credit check expedia provides easy access to credit scores and reports. Its features include identity theft protection and personalized tips for credit score improvement.

Option 3: Free Credit Monitoring Services

For those on a budget, several free services offer basic credit score monitoring. While these may lack advanced features, they still provide valuable insights into your credit health.

FAQ

-

What is the best time to monitor my credit score?

It is advisable to monitor your credit score monthly to stay informed about any changes or inaccuracies.

-

Are free credit monitoring services reliable?

While free services offer limited features, they can still provide basic insights into your credit score and alert you to significant changes.

-

How do credit monitoring services alert users?

Most services send alerts via email or SMS, notifying users of any changes in their credit report or score.

Choosing the right credit score monitoring service depends on your personal needs and financial goals. By exploring options like Credit Check Bureau, Credit Check Expedia, and free services, you can make an informed decision that supports your financial health.

Get credit reports and credit scores for businesses and consumers from Equifax today! We also have identity protection tools with daily monitoring and ...

Monitoring with Experian begins within 48 hours of enrollment in your trial. Monitoring with Equifax and TransUnion takes approximately 4 days to begin, ...

There are three credit agencies: TransUnion, Equifax, and Experian. When you apply for a loan, request an increase on your credit limit or even apply for a new ...

![]()